Churchill Mortgage: Compete with Cash Offers

How to Buy A House:

Your Mortgage 101

Your Guide to Getting the Best Interest Rate

Churchill Mortgage: Compete with Cash Offers

How to Buy A House:

Your Mortgage 101

Your Guide to Getting the Best Interest Rate

Churchill Mortgage: Compete with Cash Offers

How to Buy A House:

Your Mortgage 101

Your Guide to Getting the Best Interest Rate

Churchill Mortgage: Compete with Cash Offers

How to Buy A House:

Your Mortgage 101

Your Guide to Getting the Best Interest Rate

Churchill Mortgage: Compete with Cash Offers

How to Buy A House:

Your Mortgage 101

Download your go-to resource for refinancing your current home

How to Buy A House:

Your Mortgage 101

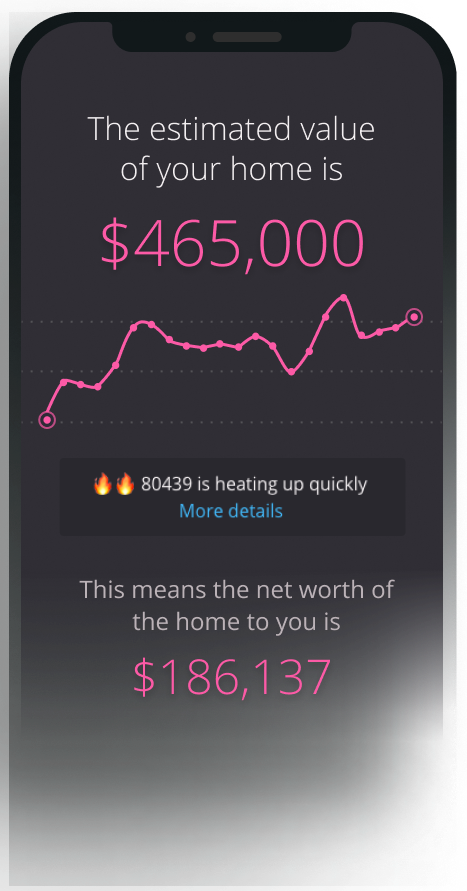

Find Your Home's Value or Search for Values in Your Area

Where We're Licensed

Don't see your state? Don't worry! We have Churchill Mortgage partners all across the country. Click Here to find out more.

Frequently Asked Questions

Q: What is a down payment and how much do I need?

A: A down payment is the cash you pay upfront to get a mortgage. It’s deducted from the total amount of your home loan. To figure out how much of a down payment you need, start with the type of loan you are trying to get. For example, you can get a conventional loan with as little as 3% down, an FHA loan with 3.5% down, and a VA or USDA with no money down. The more money you put down for a down payment, the less your monthly mortgage payment will be. Reach out to Mike, Rick, or Kevin to help you with your unique situation.

Q: What are closing costs and how much do I have to pay?

A: Closing costs are the charges you are required to pay before your mortgage is completed and fully funded. Typically, home buyers will pay anywhere between 2% and 5% of the loan amount in closing fees. For example, if your home costs $250,000, you could pay anywhere between $5,000 and $12,500 in closing costs. You will receive your closing costs from your Home Loan Specialist in a Loan Estimate that you will receive after you apply for your home loan and in the Closing Disclosure document that is provided before your official closing day.

Q: Do I need good credit to get a mortgage?

A: It is possible to get a conventional mortgage with a credit score as low as 620 and an FHA loan with a credit score of at least 580. However, be aware that the lower your score, the higher your interest rate will be. Churchill Mortgage also offers zero credit score loans which means if you have paid off all your debt and have a credit score of zero, we can still provide a home loan to you and provide you with guidance on how to pay off your home as soon as possible. Reach out to find out more information about no score loans and how we can help.

Q: How is my mortgage payment determined?

A: Depending on your situation, there are typically three or four parts that roll into your monthly mortgage payment:

• Principal: This is the repayment of what you initially borrowed for your home loan.

• Interest: This is the payment of the interest charged on the original amount you borrowed for your home loan.

• Taxes: Annual property taxes will be included in your mortgage payment and depending on if you have an escrow account or not, it might be deposited into that account.

• Insurance: This includes your homeowner's insurance and any other hazard insurances you are required to have (like flood or hurricane insurance, for example). If you put less than 20% down on a conventional loan, this can also include private mortgage insurance, and if you have an FHA loan this could also include a mortgage insurance premium.

Q: Can I get a mortgage if I’m self-employed?

A: Yes! This is a common misconception that you cannot get a mortgage if you are self-employed (or that it’s more difficult). You will need to provide evidence of an active income (i.e. the money you earn for your work). You may also be asked to provide documentation proving the stability of your business.

Q: Should I get a fixed-rate or an adjustable-rate mortgage?

A: The majority of home loans today are fixed rate. Only about 3% of home buyers are choosing to go with an adjustable-rate mortgage (ARM). An adjustable-rate mortgage can be risky because your interest rate will fluctuate over time which means your monthly payment will also go up and down. Many ARMS will start at a lower interest rate compared to a fixed-rate mortgage, but will then go up to a much higher interest rate. Set up a call with us so we can discuss which option is best for you.

Q: What does it mean to lock or cap your interest rate? What is the best time to do this?

A: When you cap your interest rate it means you are guaranteed today’s mortgage interest rate for up to 90 days through the Churchill Rate Secured program. You’ll be able to protect yourself from fluctuating interest rates by locking or capping your rate. So, if you’re thinking about buying a home in the next three months it’s best to secure a low interest rate to save you money. If you don’t find a home in that initial 90-day period, you can reset your rate for another three months.

Q: What are discount points and should I pay them?

A: Mortgage points are also known as discount points. They are basically prepaid interest on your home loan. In other words, points let you make a trade off between what you pay upfront at closing versus what you pay monthly later. It’s not always beneficial to “buy down” your interest rate. In fact, you could lose money. Each point is equivalent to 1% of your total loan amount. For example, on a $200,000 mortgage, one point would cost you $2,000 directly out of your pocket. This money is in addition to your down payment and adds to your total closing costs. A one-point discount does not necessarily equal a 1% lower interest rate. Click here for more information about seeing if points are worth the cost or schedule a call with us today.

Q: Should I get a 15-year or a 30-year loan?

A: This depends. A 15-year loan term usually comes with a better interest rate compared to a 30-year loan term. You will pay off your home quicker with a 15-year mortgage and will save a large amount of interest. On the other hand, a 30-year term will cost less per month.

Q: What documentation do I need to get a home loan?

A: You will be asked to provide many different documents including but not limited to: Income verification (such as the last two years’ tax returns, W-2s, 1099s, pay stubs, etc.), driver’s license and social security card, bank statements, proof of funds to close, etc.

Q: What is an escrow account?

A: Many mortgage lenders hold money that you’ve paid in an escrow account to pay your property taxes, homeowner’s insurance, and in some instances even your homeowner’s association (HOA) fees. This makes it as easy as possible so you only have to make one mortgage payment a month and you don’t have to think about ongoing annual payments for your insurance and property taxes. Your lender will calculate how much your property taxes and homeowner’s insurance premiums are for the entire year, and then divides them by 12 (one payment per month). You’ll then pay that amount each month along with your standard mortgage payment, and in return, your lender will manage the escrow account and submit payments for your property taxes and homeowner’s insurance when they are due. In some states such as Hawaii and California, escrow is referred to as impounds. Click here to learn more.

Q: What is a pre-qualification?

A: Any loan officer or lender can say you are “pre-qualified.” A pre-qualification is based on information you provide. It is not a verification of your income and assets. While this may seem like the quickest and easiest option, you’re not actually approved for financing. This can be a big problem if you’ve invested weeks or even months of your time and effort looking for the right home and it’s sold from underneath you while you’re trying to get your loan approved.

Q: What is a pre-approval?

A: A standard pre-approval takes a little more time than a pre-qualification since you’ll need to submit financial documents to your lender for review. A standard pre-approval can help you determine how much you can afford before you start looking for a house doesn’t mean a mortgage underwriter has reviewed your file, resulting in a less reliable approval.

Q: What is a Certified Home Buyer?

A: This is the best option if you’re looking to buy a home, especially when the competition is high. When you become a Certified Home Buyer, you are submitting your financial documents to be reviewed by an actual underwriter. You can be conditionally approved for financing on a new home without a property address. You’ll do a bulk of the leg work up front which makes the home buying process quick and seamless once you’ve found your dream home. This will give both you and the seller of the home peace of mind that your funds will be approved when it’s time to sign on the dotted line. Schedule a call with us today to learn more.